Table of Contents

- 1. The Quiet Revolution Happening in Your Wallet

- 2. Truth #1: AI in Fintech Knows You Better Than Your Banker Ever Did

- 3. Truth #2: Algorithms Are Now Your Financial Advisors

- 4. Truth #3: Fraud Has a New Enemy — AI That Doesn’t Sleep

- 5. Truth #4: AI in Fintech Is Helping the Underserved Get Approved

- 6. Truth #5: Behind Every “1-Click” Experience Is a Fintech AI Brain

- 7. Truth #6: AI Is Rewiring the Entire Backend of Fintech

- 8. Truth #7: Your Data Is Currency, and AI Is the Trader

- 9. Truth #8: This Is Just the Beginning — Fintech Is Training AI to Think Like Investors

- 10. Viral Moment: What If AI Was Your CFO?

- Want Your Fintech to Think Smarter?

- 5 Burning FAQs on AI in Fintech

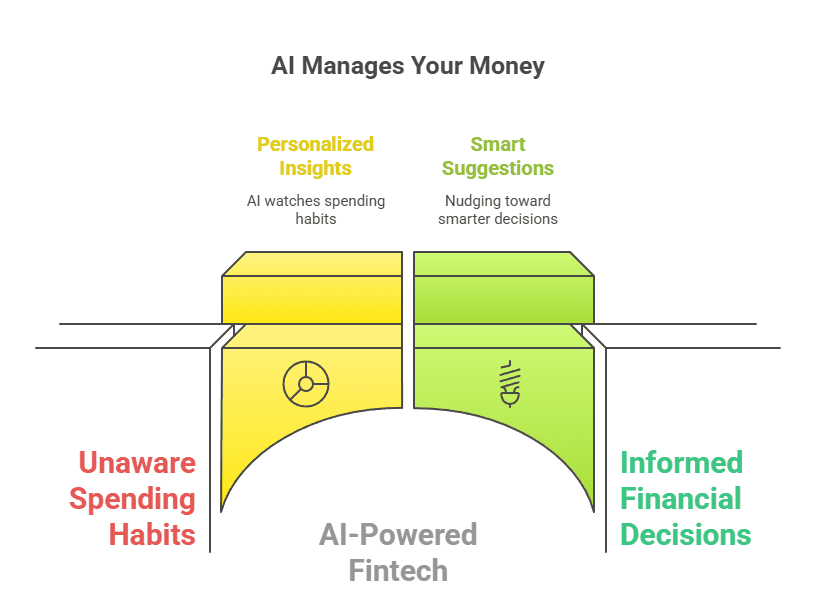

1. The Quiet Revolution Happening in Your Wallet

How AI is already managing your money — and you didn’t even notice.

Picture this:

You’re chilling on your couch. You check your finance app—maybe it’s Chime, Wealthsimple, or Mint—and it tells you:

“Hey, your grocery spending was 27% higher this week. Here’s how to bring it down.”

Feels personal, right?

But no human typed that message. No accountant was behind it. That insight was served up by an AI — watching your habits, learning your patterns, and gently nudging you toward smarter decisions.

This isn’t science fiction.

It’s fintech reality.

According to a 2023 report by Statista, over 50% of financial services firms globally have adopted AI in at least one business function. And in North America, the momentum is even stronger — especially in fintech, where speed, personalization, and trust are everything.

From robo-advisors that optimize your investments to fraud detection systems that monitor millions of transactions in milliseconds — AI is powering the tools people use every day, often without realizing it.

So if you’ve ever been auto-approved for a credit card, flagged about a suspicious charge, or given a hyper-personalized savings tip — chances are, you’ve already experienced fintech artificial intelligence firsthand.

The twist?

Most people have no idea it’s happening.

That’s why this blog exists.

We’re pulling back the curtain on 8 shocking truths about AI in fintech — the real stories, surprising use cases, and big shifts reshaping how money moves across the USA and Canada.

Because if AI is already in your wallet…

Shouldn’t you know what it’s doing?

2. Truth #1: AI in Fintech Knows You Better Than Your Banker Ever Did

And it doesn’t even need small talk to do it.

You ever had your bank call and say:

“Hey Ashim, we noticed you’re spending more on late-night food deliveries. Everything okay?”

Nope?

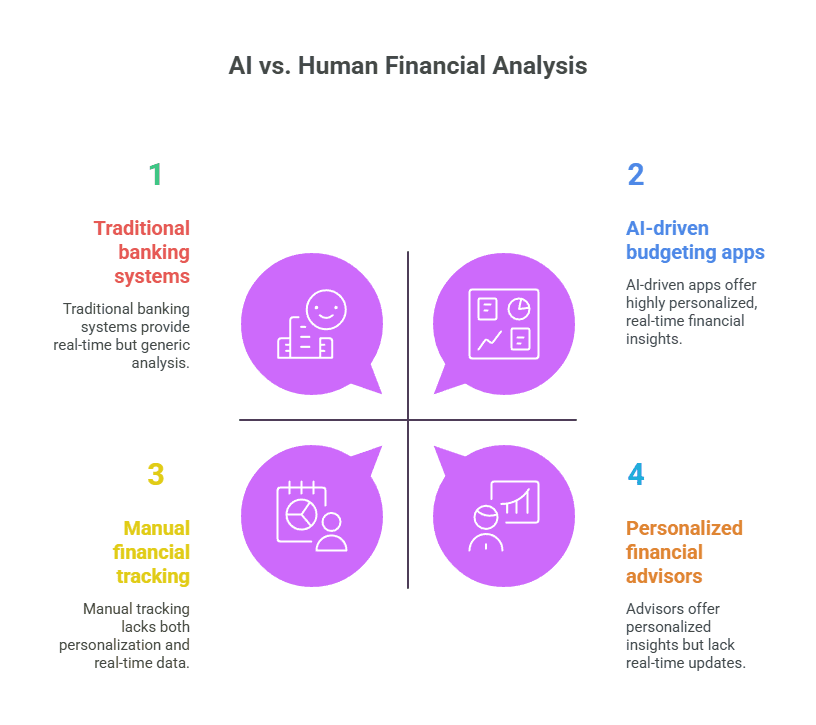

That’s because humans in finance operate on outdated rules and generic assumptions. AI, on the other hand, works in real time — and with insane levels of personalization.

Let’s talk about how.

AI Watches Everything (But Not in a Creepy Way)

When you link your bank account to a budgeting app like Cleo, Mint, or YNAB, what happens behind the scenes?

AI gets to work. It scans your transaction history, finds patterns, and builds a behavioral profile more accurate than most financial advisors could manage.

It knows you spend $42 every Sunday on groceries, that you tip extra on rideshare apps, and that you always pay your credit card bill right before midnight.

Now it doesn’t just track — it predicts.

It knows when a bill’s about to bounce before you do. It warns you about a budget overrun while you’re still at the checkout counter. It can even tell if your spending mood is shifting based on time of day or day of the week.

This Isn’t Spreadsheet Logic. It’s Behavioral AI.

Fintech AI isn’t just crunching numbers.

It’s analyzing context. Are you emotionally spending? Did your paycheck arrive late? Are you using “Buy Now, Pay Later” more often?

Behavioral AI models like those used by Qapital or Plum factor all that in — and then deliver nudges, not nags.

So instead of saying “You’re overspending,” it might say:

“Looks like you’ve gone over your monthly eating-out budget by $63. Want us to set a limit for next week?”

It’s financial advice that feels human — but scales like tech.

3. Truth #2: Algorithms Are Now Your Financial Advisors

And they’re doing it without yachts, suits, or coffee breath.

Once upon a time, if you wanted financial advice, you sat across from a guy in a grey suit, hoping he didn’t just pitch you insurance.

Today?

You download an app, answer a few questions, and boom — you’ve got a portfolio tailored to your goals, risk level, and timeline.

And yep, it’s all powered by AI.

Robo-Advisors Are Running the Show

Platforms like Betterment, Wealthfront, and SoFi Invest have exploded in popularity across the US and Canada. Why?

Because they remove the friction, the bias, and let’s be honest — the intimidation.

Here’s how it works:

- You answer a quick questionnaire

- AI assesses your goals, age, income, and comfort with risk

- It builds an ETF-based portfolio and rebalances it automatically

- You sit back and chill

No awkward meetings.

No jargon.

No upselling.

These robo-advisors use advanced machine learning algorithms to constantly refine their asset allocation strategy based on market trends and historical data. The more you use them, the smarter they get.

Humans? Optional. Not Necessary.

Now, are humans completely out of the picture?

Not really — most platforms still offer access to licensed advisors for complex situations. But for the average user in their 20s to 40s just trying to build wealth? AI does it faster, cheaper, and honestly… better.

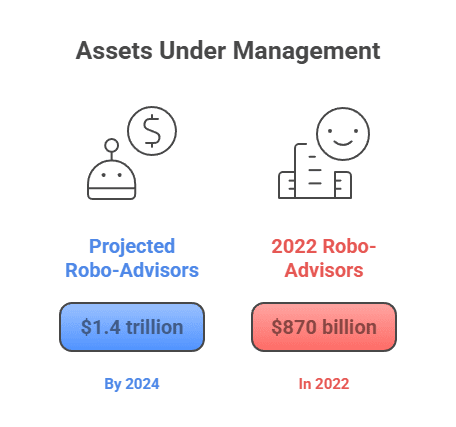

According to Statista, robo-advisers managed $870 billion in assets in 2022 and are projected to manage $1.4 trillion by 2024. That’s a strong vote of confidence for fintech AI companies building smarter investment ecosystems.Financial Planning Association

And the crazy part?

These robo-advisors don’t panic-sell.

They don’t chase hot stocks.

They don’t ghost you when the market dips.

They just… execute. Efficiently.

4. Truth #3: Fraud Has a New Enemy — AI That Doesn’t Sleep

And it catches criminals before your morning coffee.

Remember the days when spotting a fraudulent transaction meant waiting for your monthly statement and playing detective with a red pen?

Yeah, fintech AI laughs at that.

Today, AI monitors millions of transactions per second.

In real time.

Without blinking.

And if anything smells off — you get a notification before the scammer finishes their next move.

🔐 AI Is the New Fraud Squad

Fintech giants like PayPal, Stripe, and Square have leveled up their fraud detection using advanced machine learning and anomaly detection models.

Here’s what that actually means:

- Your card is used in New York and then in Vancouver 4 minutes later? Flagged.

- You’re spending like a college student Monday through Friday, and suddenly there’s a $3,000 Rolex order? Flagged.

- You’ve never used a certain merchant, and now there’s a weird recurring charge? Blocked and reversed.

AI models learn what your normal looks like — and alert you when things go off script.

Unlike traditional systems that work off fixed rules, AI adapts and evolves. It’s not just looking at what was spent — it looks at location, timing, behavior patterns, device type, and even typing speed.

🔍 Real Example: PayPal’s AI Defense

PayPal processes over 1 billion transactions monthly, leveraging AI and machine learning to detect and prevent fraudulent activities. In 2015, PayPal’s fraud rate was reported at 0.32% of revenue, significantly lower than the industry average of 1.32% at that time. This achievement underscores the effectiveness of AI-driven fraud detection systems in reducing financial losses and enhancing security.

Fintech AI doesn’t just stop fraud.

It learns from every attempt.

The more criminals get clever, the smarter the system becomes.

So while you’re sleeping — your AI security system is busy outsmarting bots, phishing schemes, and human hackers across the globe.

And it never gets tired.

5. Truth #4: AI in Fintech Is Helping the Underserved Get Approved

Because your credit score shouldn’t define your future.

Let’s be real. Traditional banking is… exclusionary.

If you don’t have a pristine credit score, long financial history, or a “stable” job, chances are you’ve been rejected for a loan, credit card, or even a basic line of credit.

Now here’s the twist:

AI is flipping that narrative.

Meet the New Risk Models: Fairer, Smarter, More Human

Instead of relying solely on old-school credit reports, many fintech AI companies use alternative data:

- Your income flow from gig work

- Your rent and utility payments

- Your education history

- Your digital transaction behavior

All of this is used to build a more complete financial profile — and it’s unlocking credit access for millions of people who were previously shut out.

Real Example: Upstart

Upstart, an AI lending platform based in the US, utilizes over 1,600 data points to assess borrower risk. This comprehensive approach goes beyond traditional credit scores, considering factors like employment history, education, and spending habits to provide a more holistic view of creditworthiness.

By leveraging this extensive data, Upstart aims to improve access to credit for individuals who might be overlooked by conventional models, offering more personalized and potentially fairer lending decisions.

That’s not just innovation.

That’s impact.

Why This Matters in the USA & Canada

In both countries, underserved groups — especially immigrants, gig workers, and young adults — often struggle to access fair credit. AI levels the playing field by seeing potential where legacy systems only see risk.

It doesn’t care about your zip code.

It doesn’t penalize you for being self-employed.

It learns who you are — financially — and gives you a chance.

That’s what fintech artificial intelligence is really about: access, fairness, and smarter decision-making at scale.

6. Truth #5: Behind Every “1-Click” Experience Is a Fintech AI Brain

Because effortless takes a LOT of intelligence.

You know that magical moment when you apply for a loan or open an account, and it’s approved almost instantly?

No “we’ll get back to you.”

No faxes. No paperwork.

Just click — done.

That’s not luck. That’s AI.

Speed Is the New Currency

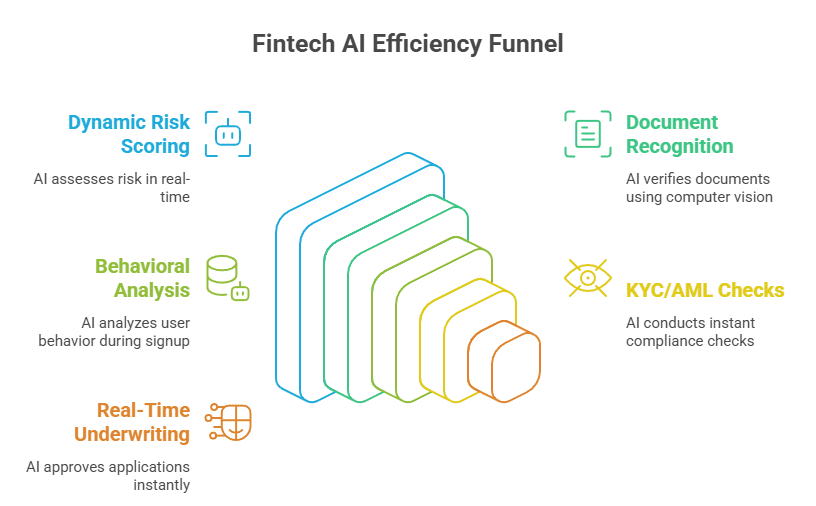

Fintechs today are obsessed with frictionless experiences. From onboarding to payments to approvals, every interaction is engineered to be real-time and zero-hassle.

AI makes that possible by powering:

- Dynamic risk scoring in milliseconds

- Document recognition and ID verification (using computer vision)

- Behavioral analysis during signup (yes, it watches how you type)

- Instant KYC/AML checks using third-party APIs + machine learning

- Real-time underwriting via custom-trained models

And all of this happens in the time it takes to refresh your feed.

Real Example: Stripe + AI

Take Stripe Radar for example — Stripe’s fraud detection engine. It uses machine learning to evaluate hundreds of signals from each transaction to predict if it’s fraudulent or not.

It does all this without interrupting the flow of purchase. Which is why millions of platforms — from Shopify to Notion — trust it to make instant decisions behind every click.

This same kind of invisible AI intelligence is being used across lending, investing, insurance, and personal finance apps in the USA and Canada.

From your first tap to final transaction, AI is the ghost in the machine making sure everything feels… easy.

7. Truth #6: AI Is Rewiring the Entire Backend of Fintech

Forget just apps — AI is rebuilding the financial infrastructure itself.

We tend to think of AI in fintech as customer-facing: fraud alerts, chatbots, robo-advisors.

But the real magic?

It’s happening under the hood.

From compliance checks to transaction routing, AI is streamlining complex, repetitive processes that used to require massive back-office teams and mountains of manual work.

The Ops Revolution Is Real

Here’s how fintechs in the US and Canada are quietly using AI in their infrastructure:

- Automated KYC (Know Your Customer)

- AI scans government IDs, cross-checks databases, and validates facial matches in seconds.

- → Manual KYC review time has dropped by 90% in many fintechs.

- AI for AML (Anti-Money Laundering)

- Instead of hard-coded rule checks, AI uses pattern recognition to detect suspicious transactions — especially those that are subtly structured to avoid flags.

- Autonomous Agents for Support & Compliance

- Companies like Skywinds Solutions are deploying LLM-powered agents that handle support tickets, escalate issues, and even perform audit checks — all without human involvement.

- AI-Driven Document Parsing & Underwriting

- Tools like Ocrolus and Hyperscience scan financial docs, contracts, and invoices, extracting data with near-perfect accuracy for faster decision-making.

Real Example: Brex

Brex, the business spend management platform, uses AI not just for customer-facing analytics, but deep in its backend systems. From real-time spend control to predictive credit line adjustments, AI handles risk logic at scale — something no human team could ever match in speed or scope.

This is what fintech artificial intelligence really looks like in 2025:

Not just smart apps.

But self-improving, always-on systems that are reshaping the finance industry at its very core.

8. Truth #7: Your Data Is Currency, and AI Is the Trader

And it’s trading insights at lightning speed.

Here’s a slightly uncomfortable truth:

Every tap, scroll, transaction, or “skip” you make is generating data.

And in the fintech world, that data is more valuable than cash.

Because when AI gets its hands on that data?

It becomes something more: predictive power.

Prediction Is the New Profit Model

Fintechs don’t just want to know what you did.

They want to know what you’ll do next.

AI models use your historical activity, device info, location data, behavioral trends, even dwell time on certain screens to make predictions like:

- Will you repay that loan on time?

- Are you about to churn from the app?

- Will you click that upsell offer?

- Are you financially stressed this week?

These aren’t guesses — they’re real-time predictions trained on millions of users and constantly updated.

And here’s where it gets even deeper…

Ethics vs. Intelligence

There’s a fine line between personalization and creepiness.

Fintech artificial intelligence can empower, but it can also manipulate if left unchecked.

For example:

- Dynamic pricing models might offer different interest rates to different users based on predicted urgency.

- Creditworthiness models may still inherit bias if not trained with diverse data sets.

- Behavioral nudging can be used to upsell instead of genuinely helping users.

This is why many leading fintech AI companies are now building “explainability layers” — ensuring users and regulators can understand why AI made a specific decision.

Transparency = trust.

And in finance, trust is everything.

9. Truth #8: This Is Just the Beginning — Fintech Is Training AI to Think Like Investors

And soon, your portfolio might be run by an LLM.

What if your next wealth manager isn’t human… or even a company?

What if it’s an autonomous agent trained on decades of market data, economic cycles, sentiment analysis, and your own personal goals?

Because that’s where fintech AI is headed.

We’re not just using AI for alerts or automation anymore.

We’re training it to make high-stakes strategic decisions — like when to move your assets, rebalance your portfolio, or shift your financial strategy altogether.

From Rules to Reasoning

The big leap here?

AI in fintech is moving from rule-following to reasoning.

Thanks to Large Language Models (LLMs) and advanced decision trees, fintech companies are beginning to test AI systems that:

- Simulate economic scenarios

- Evaluate emotional risk tolerance (based on your behavior + history)

- Write financial plans tailored to your real-world data

- Auto-optimize tax strategies across investment accounts

Real Example: Composer

Composer is a Canadian fintech platform that lets users create algorithmic trading strategies without code. Behind the scenes, AI helps simulate and test various investing strategies based on real market data — essentially letting users “train” their own robo-hedge fund.

This kind of AI logic will soon evolve into autonomous financial agents — systems that don’t just follow instructions but generate and execute investment theses.

And yes, they’ll be available for regular people.

Not just hedge funds.

We’re talking about a future where your AI doesn’t just send push notifications…

It tells you:

“We’re reallocating 10% of your holdings to weather an upcoming dip — based on 82% confidence in a sector pullback.”

No panic.

No guesswork.

Just AI thinking ahead — and acting in your best interest.

10. Viral Moment: What If AI Was Your CFO?

Seriously—what would that even look like?

Let’s imagine your life with a full-time Chief Financial Officer.

But instead of a $300K/year exec in a suit… it’s a self-improving AI.

Here’s what your daily finance life might look like:

Your AI CFO: The Daily Briefing

“Morning! Rent is due in 3 days. Cash flow looks good. But Uber Eats is spiking again—$124 this week already. Want to set a cap?”

The Monthly Report

“You saved 14% of your income this month. We also moved $600 from your low-interest account into a 3-month T-bill yielding 5.1%.”

The Investment Decision

“There’s a 78% chance of a market pullback in mid-cap tech. I recommend shifting 10% of your holdings to energy ETFs.”

The Risk Alert

“Noticed an unusual login attempt from Mexico. I froze the card ending in 5289 and sent a replacement.”

You don’t need spreadsheets.

You don’t need budgeting apps.

You don’t even need to think.

AI is literally managing your financial life — intelligently, empathetically, and in real time.

Now pause and really think:

If this is what AI can do for you as an individual…

What can it do for your fintech product or platform?

Want Your Fintech to Think Smarter?

If you’re building a fintech product and not using AI, you’re already behind.

At Skywinds Solutions, we don’t just integrate AI — we engineer it to think, act, and scale like your smartest team member.

Whether you’re building from scratch or leveling up an existing fintech platform, our generative AI and automation services give you the edge to move faster, serve better, and scale confidently.

Explore AI-Powered Automation for Fintech

5 Burning FAQs on AI in Fintech

Q1. Is AI in fintech secure and reliable?

Yes — in fact, it’s often more reliable than traditional methods. AI detects fraud faster, flags risky behavior early, and adapts in real time.

Q2. Are fintech companies in the US and Canada already using AI?

Absolutely. Major players like Stripe, PayPal, Brex, Wealthsimple, and Upstart use AI in risk scoring, compliance, customer service, and investment tools.

Q3. Can AI actually help underserved communities get financial services?

Yes. AI-powered lending models often use alternative data to approve users overlooked by traditional credit scoring systems.

Q4. What types of AI are used in fintech?

Fintech companies use machine learning, NLP (natural language processing), computer vision, and large language models (LLMs) to optimize everything from UX to risk analytics.

Q5. Is AI expensive to implement in a fintech product?

Not necessarily. With modern tools and pre-trained models, AI can be integrated affordably. Partnering with AI-focused dev teams like Skywinds helps lower cost and time-to-market.