Financial technology has advanced quickly, changing how businesses streamline their financial operations. The FinTech sector has seen an explosion of creative solutions over the past ten years, enabling eCommerce businesses to fund sophisticated sales strategies, spur growth, and efficiently manage financial services. Numerous online businesses have grown to impressive heights due to the symbiotic relationship between FinTech and eCommerce.

This blog explores the complex relationship between Fintech and eCommerce, illuminating how Fintech app development becomes the ideal solution for online businesses.

Why does eCommerce Demand for Fintech?

With time, businesses have realized that integrating technology into their operations is essential to optimize their bottom line and increase their client base, especially for e-commerce businesses. Banks have been using fintech tools and software to streamline their processes, while brick-and-mortar stores have embraced e-commerce culture to reach more customers.

What is Fintech?

Finance+Technology is FinTech Development. FinTech solutions offer financial products and services more cheaply and efficiently than traditional institutions. FinTech Development companies use new technologies to design financial products and services that address traditional architecture flaws.

FinTech firms offer digital banking, online lending, mobile payments and wallets, investing platforms, insurance technology, and more using emerging technologies like Blockchain and artificial intelligence. FinTech firms offer businesses and consumers faster, cheaper, and simpler financial management.

Some examples of fastest growing fintech companies are Binance.US, CoinTracker, CoinDCX, etc.

The success of e-commerce depends on the synchronization of buyer and seller behavior. Therefore, achieving an equilibrium between supply and demand is crucial.

Fintech has played a vital role in the growth of the e-commerce ecosystem. Numerous businesses aspire to make it big in the e-commerce world but need more financial assistance to set up a business, buy inventory, and so on. Traditional banks and credit card companies hesitate to grant buy now, pay later options due to low credit scores or other reasons.

Facilities such as quick mobile payments and digital wallets have made online banking more accessible to everyone. With innovative tools & payment platforms, the Fintech industry makes it easy for everyone to make online transactions & thus participate in eCommerce growth.

The statistics speak for themselves. Fintech and e-commerce account for more than 60% of the market value of I.T. companies in countries such as Argentina & Brazil.

In 2024 global investment in Fintech startups is expected to reach roughly $188 billion. This highlights the rising number of online shoppers and the impact of Fintech on the eCommerce sector and its profitability ratios.

Fintech can help businesses and financial institutions grow in eCommerce. Using the right fintech tools and software, they can boost their profits and customer base.

With the success of fintech technology in e-commerce, we can expect more innovations and tools that cater to the needs of businesses & consumers alike.

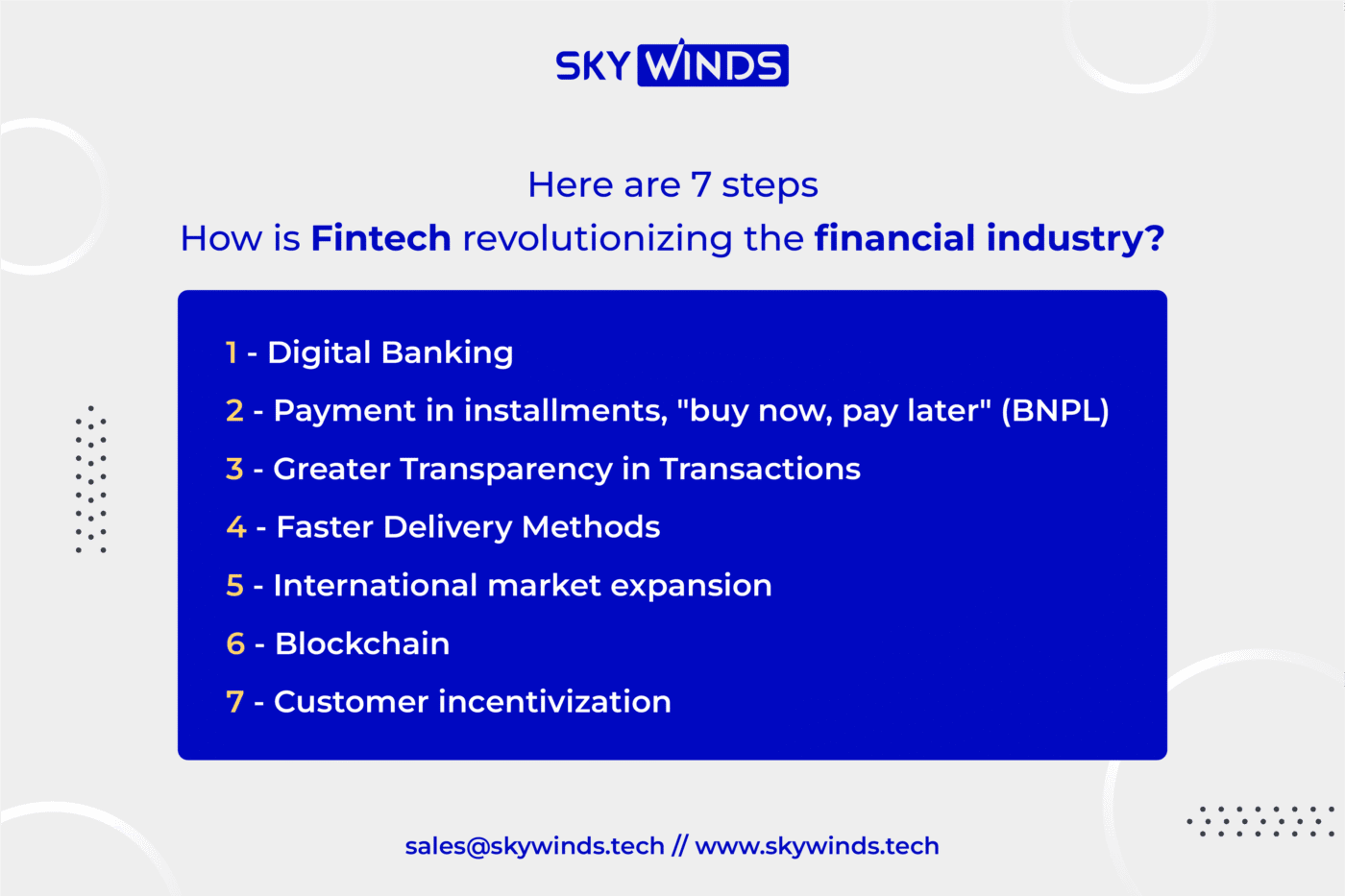

How Fintech is revolutionizing the Financial Industry?

1. Digital Banking

Digital banking payments have completely changed how companies handle their cash flow. By providing online banking services, mobile cheque deposits, and digital money transfers, traditional banks have adapted to the digital environment.

The substantial infrastructure costs associated with physical bank branches are frequently passed on to customers through maintenance fees, minimum balance requirements, and transaction limits. Alternatives have, however, been made available by technological advancement.

Digital payment platforms and online banking provide the same services without additional fees. Digital payments are a game-changer for eCommerce stores because they simplify the payment process and do away with the need for physical transactions.

Due to the simplicity of digital transactions, cash flow concerns for eCommerce vendors are reduced, and the payment process is streamlined and effective.

2. Payment in installments, “buy now, pay later” (BNPL)

Fintech disruptors in the form of “buy now, pay later” (BNPL) services, such as Affirm, Klarna, and Afterpay, have been instrumental in reshaping consumer behavior. Initially gaining popularity in European markets, these BNPL companies also make waves in the United States.

In 2021, BNPL transactions in the United States reached $100 billion and are expected to reach $1.2 trillion by 2025.

These statistical data are just a few pieces of evidence showing how BNPL is revolutionizing the financial industry and impacting this world. BNPL could make it easier for consumers to access credit, and it could also help to reduce the number of people who are struggling with debt.

3. Greater Transparency in Transactions

Transparency in transactions has improved due to the digital revolution in Fintech, banking, and eCommerce. The absence of physical visibility in an online transaction frequently raises suspicions.

However, the fintech services industry, undergoing significant transformation in the digital age, is laying the groundwork for significant economic growth alongside related sectors such as banking and eCommerce.

Transparency in transactions is a prominent feature made possible by Fintech technological advancements. Users gain seamless access to eCommerce sites that accept payments through the platform by linking their bank account to their preferred fintech platform. Integrating bank accounts and fintech platforms simplifies the payment process, giving users convenience and ease of use.

4. Faster Delivery Methods

The quest for faster delivery methods in eCommerce has led software companies to explore the use of drones. Although drone deliveries are still experimental, ongoing technological advancements are expected to overcome existing limitations. This will enable drones to transport more oversized cargo and cover longer distances. Faster delivery is an integral part of everyday eCommerce operations.

The innovations brought about by Fintech have already revolutionized the world of e-commerce, making online shopping processes faster, easier, and more accessible globally. Countries are collaborating to bridge gaps and harness the benefits of Fintech to enhance global e-commerce. The breakthroughs in the Fintech industry will streamline business delivery management and ensure customer satisfaction in one cohesive package.

5. International market expansion

Fintech has wholly transformed the global eCommerce sector by facilitating global market expansion. Traditional geographic restrictions no longer prevent buyers from making cross-border purchases. Payment systems and e-wallets have made eCommerce accessible globally, enabling customers to order goods and services from anywhere in the world without ever leaving their homes.

As a result, eCommerce sellers now have access to a much broader market and can target their ideal clients wherever they may be. The global nature of eCommerce powered by Fintech has opened up new opportunities for companies, promoting growth and a truly global mark.

6. Blockchain

Blockchain is the concept that most closely resembles the word security in the world of finance. Blockchain is a brand-new area of technology created to protect the financial data of both companies and customers. It describes a database frequently used to track and document transactions, including money transfers, contracts, and shipments.

Blockchain works as a public ledger, storing information in interconnected blocks organized chronologically. Maximum accuracy and transparency are guaranteed by the fact that this data is publicly accessible, time-stamped, and permanent. Businesses can more easily trace their supply chains, improve inventory control, cut costs, and realize additional eCommerce potential by utilizing the power of Blockchain.

7. Customer incentivization

eCommerce businesses and customers greatly benefit from the fierce market competition between fintech companies and traditional businesses. Fintech companies frequently work with well-known brands to give customers enticing incentives like special discounts and alluring deals.

Fintech payment companies compete for customers by offering rebates, flat discounts on purchases, and occasionally even free movie tickets. These customer incentive programs have increased online spending, which has increased online sales and encouraged the expansion of eCommerce as a whole.

The competition among fintech firms ultimately improves customers’ shopping experiences while fostering the growth of the online retail environment.

Benefits of Fintech in Ecommerce

Embracing Fintech in the many ways we covered will enable eCommerce firms and small businesses to:

- Optimize operations: Fintech makes transactions safer and more accessible. eCommerce companies can simplify checkout with online banking and payment processors.

- Avoid fraud: Fintech improves security, reducing fraud. Old digital payment methods mainly check logging-in activity. Fintech requires credentials, CAPTCHAs, and MFA when possible to verify credentials.

- Faster scaling: Financial technology helps firms reach more people. Accepting multiple payment methods and currencies lets e-commerce retailers sell worldwide. This scalability opens doors for businesses of all sizes and grows the eCommerce industry.

- Transform B2B experiences: E-commerce companies must offer B2B customers B2C-like payment options to satisfy their instant gratification needs. Fintech aids this.

- Faster checkout increases sales: Fintech can also speed up checkout. Using stored payment and shipping information, automated checkout, or one-click purchases can save time.

- Improve customer convenience: Customers can shop online or in person. Mobile devices and apps make this easy and ubiquitous. WhatsApp and Facebook let users do business without leaving the app. Chatbots and digital assistants can connect eCommerce businesses to customers.

Wrapping up

Fintech and eCommerce have created a new era of growth and innovation. Fintech’s impact on the financial industry and its seamless integration with eCommerce have changed how businesses and consumers interact in the digital marketplace. Businesses must keep up with Fintech trends and use industry experts to stay ahead.

Skywinds Solutions is a leading fintech software development company that creates customized solutions for U.S. and international businesses. Our experts understand the financial technology landscape and can develop innovative software solutions that meet your business needs. Our fintech software solutions can transform your eCommerce operations by enabling seamless online payments and optimizing financial management.

Skywinds Solutions provides cutting-edge solutions to clients. We will help your startup or established business succeed using Fintech’s transformative power. To unlock new financial technology possibilities, partner with us. Click here to learn more about us.