Overview of Android 14 and its significance for fintech app developers

Android OS was trying to remain at the top of its game and is also rapidly evolving in the field of mobile technology. To remain at the top of its game recently, Google has launched its new version known as Android 14. It provides a variety of changes and optimizations that enhance Android device performance, safety, and user interface. With the release of Android 14, financial app developers now have access to a wide range of capabilities for building safe, quick, and user-friendly applications.

Importance of ensuring seamless compatibility for fintech apps

The fintech industry has increased in recent years, partly due to consumer demand for efficient financial services and rising smartphone usage. Fintech apps have several benefits, including easy access to financial data, quick and secure payments, and more straightforward investing options.

Ensuring seamless interoperability for fintech apps is crucial. Financial services are revolutionized by fintech apps, which increase their use and effectiveness. To provide a seamless user experience and realize the full potential of these applications, compatibility must be given top priority.

Fintech apps’ interoperability ensures that they can be used on various platforms and devices. Compatibility guarantees that apps work correctly on a variety of smartphones, tablets, and web browsers due to the diversity of operating systems and devices available to users. This wide range of accessibility improves user convenience and broadens the app’s user base.

Fintech app testing seeks to ensure that the application functions correctly and meets the business requirements. It entails checking that the software does the tasks it was designed to, such as processing payments, transferring funds, and maintaining budgets.

For financial apps to provide an outstanding user experience, enable interoperability, and promote innovation, flawless compatibility is essential. Fintech businesses may better serve customers’ changing requirements, increase financial inclusion, and improve digital financial services by putting compatibility first.

Introduce your fintech app development company and its expertise in Android app development.

You continually search for ways to make your operations better as a business. Using technology to accomplish this is one of the best approaches. For companies like yours, the FinTech sector has made it easier than ever to put new solutions into practice that will help your organization expand quickly and increase income. Fintech app development is also one of the most well-liked contemporary options.

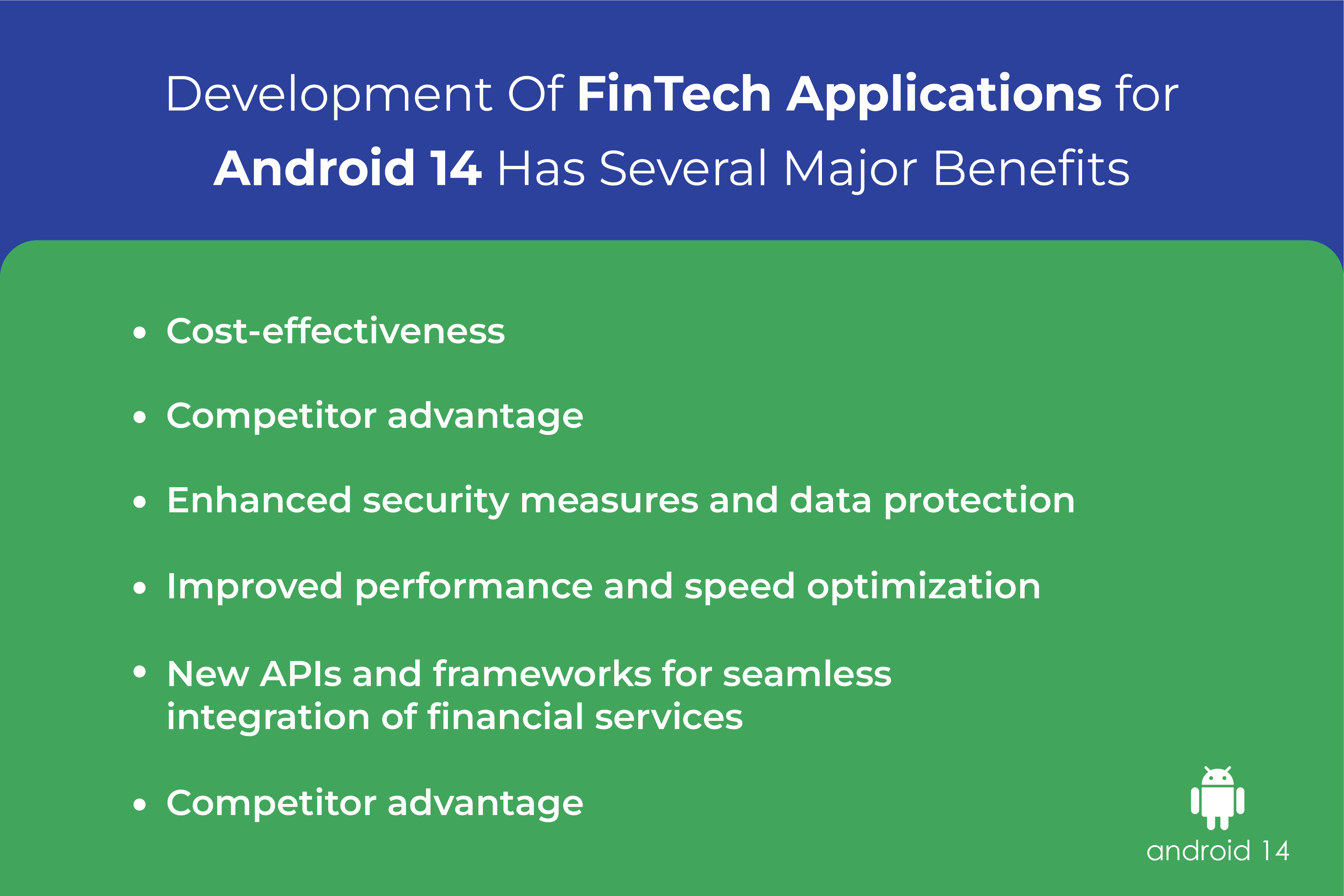

Development Of FinTech Applications Has Several Major Benefits

1.Cost-effectiveness – The company that develops fintech apps can pick the best technology to create a feature-rich fintech app for your business, allowing you to operate operations reasonably effectively. Outsourcing is a cost-effective option for app development because it may help you cut costs on things like payroll, hardware and equipment, and administrative fees while creating unique applications.

2. Competitor advantage – Unquestionably, a feature-rich, future-ready financial app can give your business an edge over competitors. A smooth-running app may help you grow your business by attracting and retaining more clients. It is a significant motivator behind the choice of fintech apps by banks and other significant financial institutions.

Understanding the Benefits of Android 14 for Fintech Apps

As the fintech industry grows, staying current with technological advancements is crucial. The well-known operating system, Android 14, just released several changes and improvements that could significantly impact the banking sector.

Enhanced security measures and data protection

Android 14 has an improved security feature, including bio, metric authentications, and better encryption methods. This improvement by Google will help provide a higher level of security for payment-related transactions and will reduce the risk of fraud.-

Improved performance and speed optimization

Android 14 was developed with the primary object to offer a cleaner and more intuitive user interface. The operating system can now increase app speed, reduce latency, and enhance animations which will help the fintech app to a more user-friendly interface,

New APIs and frameworks for seamless integration of financial services

Since the release of Android 14, developers have been able to construct cutting-edge financial solutions thanks to new APIs and improvements. These APIs can be used by fintech companies to create dependable applications that provide a range of services and customized financial insights. Access to cutting-edge custom fintech development companies in the USA services like account management, historical transaction data, and real-time financial data is made possible through these APIs.

Numerous advantages brought by Android 14 are advantageous to businesses and users of financial apps. With its improved user experience, extensive APIs, and increased security, Android 14 gives businesses the tools they need to create feature-rich, safe, and intuitive banking applications.

These advantages improve the fintech experience overall and enable customers to handle their money effectively and securely. The release of Android 14 presents an opportunity for companies to expand their user base and offer cutting-edge financial solutions. For fintech software development to continue to expand and satisfy the changing needs of users and businesses, it is essential to embrace the advantages of Android 14.

Assessing the Compatibility of Your Fintech App

Fintech apps have transformed how we handle our finances, providing users worldwide with convenience and accessibility. However, to provide a flawless user experience, evaluating your fintech app’s compatibility is critical.

Reviewing APIs and libraries used in the app

Examining the APIs (Application Programming Interfaces) and libraries used in your program is an essential component of compatibility examination. APIs are the building pieces that allow different software components to communicate with one another, whereas libraries provide pre-written code for specialised capabilities. It is critical to keep these APIs and libraries up-to-date and consistent with the most recent standards and versions.

Identifying potential issues and deprecated functionalities

It is critical to discover any potential flaws or deprecated capabilities in your software during the compatibility study. This involves looking for deprecated methods or functions no longer supported by newer operating systems or software framework versions. You may take the necessary actions to remedy these issues and ensure optimal compatibility if you notice them early on.

Compatibility is essential for your Fintech app to offer a seamless user experience. Compatibility problems can cause crashes, glitches, and general user unhappiness. Thus, it is essential to give compatibility testing and maintenance a top priority.

Minimising crashes and bugs

When a program is not thoroughly tested on various devices and operating system versions, compatibility problems can occur. This can lead to random crashes or broken functionalities, harming the user experience. Consistent compatibility testing enables the detection and correction of these problems, delivering stable and dependable software. You can reduce the likelihood of program crashes and issues by verifying compatibility.

Maintaining app functionality across different devices and Android versions

Compatibility testing is crucial to ensure app operation across different devices and Android versions. Users may use various devices with varied hardware specs and screen sizes. Furthermore, there are numerous variations of the Android operating system available. By ensuring compatibility, your software can adapt to and run effectively on many devices, giving all users a consistent experience.

Strategies for Upgrading Your Fintech App to Android 14

Staying current with the newest technologies is essential for keeping a competitive edge in the quickly expanding fintech industry. Upgrading your financial app to Android 14 is necessary to maintain compatibility, security, and an improved user experience as the Android operating system continues to develop. The following are efficient methods for updating your fintech application for Android 14.

Addition of Security Measures

To comply with the most recent security guidelines and best practices:

- Evaluate and upgrade your app’s security safeguards.

- Implement encryption methods, authentication strategies, and secure communication protocols.

- Keep an eye on security libraries and dependencies and update them frequently to fix any flaws.

Coverage of tests and automation

Create a thorough testing strategy that addresses all of your app’s requirements, including functional, compatibility, and regression testing. To speed up the testing process and increase effectiveness, use automated testing frameworks. Update your test suites frequently to reflect the new Android 14 features and modifications.

It’s critical to evaluate an app development company’s proficiency in migration and compatibility upgrades when choosing them for your Android 14 upgrade. Seek out businesses with a track record of effectively converting banking apps to Android 14 for development. Verify if they have a committed crew that is well-versed in the Android platform and has handled projects similar to yours.

Ask for success stories or case studies displaying their prior Android 14 upgrade initiatives to acquire confidence in an app development company’s ability. You may learn more about their methodology, ability to solve problems, and ability to produce outcomes from this. Successful case studies show how they can overcome obstacles and accomplish their goals, giving them a dependable option for your financial app upgrade.

The steps involved in upgrading your fintech app to Android 14 hassle-free

- Conducting a thorough code review and refactoring – Conducting a thorough code review is the first step in bringing your banking app up to Android 14 compatibility. This includes reviewing the current codebase to find areas that could use improvement, refactoring out-of-date code, and performance optimization. A comprehensive code review ensures a stable upgrade base and aids in removing any potential compatibility problems.

- Adapting app design and UI to meet Android 14 guidelines – The new design principles and UI components in Android 14 improve user experience and aesthetic appeal. It’s critical to modify the design of your fintech app to comply with these recommendations. This entails making layouts as efficient as possible, utilising the proper themes and styles, and ensuring that all screen resolutions and sizes are supported. Your app will be more user-friendly and engaging users if it adheres to the design guidelines of Android 14.

- Testing and debugging to ensure compatibility and stability – To ensure that your updated fintech app is compatible with Android 14, careful testing is essential after applying the required code and design modifications. This entails functional, performance, and compatibility testing across a range of platforms and screen sizes. To guarantee stability and a seamless user experience, any problems or faults that surface during testing should be fixed right away.

Industry-Specific Considerations and Examples

App updates are essential for being competitive in the ever-changing financial technology (fintech) market. Several industry-specific issues and factors need to be considered while modernising financial apps.

Compliance with financial regulations and security standards

Data security and regulatory compliance are paramount in the fintech sector. An app must be updated to ensure that it complies with all applicable financial laws and security guidelines. To accomplish this, robust encryption techniques must be used, data must be stored securely, and regulations like the General Data Protection Regulation (GDPR) and Payment Card Industry Data Security Standard (PCI DSS) must be followed. To guarantee a smooth transition while preserving regulatory compliance, fintech companies must collaborate closely with legal and compliance departments.

Integration with payment gateways and third-party financial services

For smooth and safe transactions, fintech app development frequently integrates with payment gateways and outside financial services. To work with the most recent payment technologies and APIs, an app may need to update its integration process. The improved software must interface with different payment gateways and outside financial services, such as banking platforms, payment processors, or cryptocurrency exchanges, without any issues.

Examples of successful fintech apps upgraded to Android 14

A popular finance app that was updated to Android 14 is “FinTrack.” The upgrade brought several advantages and enhancements, including better app performance, an improved user interface, and more security precautions. The updated software took advantage of the most recent Android capabilities, which led to quicker transaction processing, more straightforward navigation, and shorter loading times. These improvements greatly enhanced user pleasure and experience overall, which increased app usage and customer retention.

The “PayGuard” app is another case, successfully updated to Android 14. The upgrade concentrated on enhancing user engagement and trust by offering personalised user experiences and introducing new security features. PayGuard implemented biometric authentication, such as fingerprint or face recognition, to offer an extra degree of protection. This update gave consumers confidence and trust in the app by assuring them that their money transactions were secure. User engagement and satisfaction rose as a result of the enhanced app’s personalised recommendations and financial insights based on user preferences and spending trends.

Conclusion

The launch of Android 14 by Google gives fintech app developers a variety of new prospects. Its potent capabilities, increased performance, and upgraded user interface pave the way for innovation in the financial sector. Developers may produce safe, fast-performing, and user-friendly banking apps that meet customers’ changing needs by utilising Android 14’s features.

With all these new features of the Android 14 fintech app, developers can create an app that ensures seamless compatibility. So if your app is working with the older version, it’s time to contact a custom fintech apps development company to get it updated with the new Android 14 feature to make it stand out in the market.